Details

PUBLISHED

Made available through hoopla

DESCRIPTION

1 online resource

ISBN/ISSN

LANGUAGE

NOTES

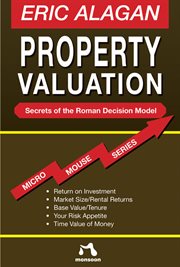

Ignore "affordability" and focus on "fair value", why pay a $1-million just because one can "afford" it, when the property is worth only $750,000.00? Helps you value property consistently and objectively using five critical parameters: 1. Return on Investment, how much money you ought to receive for the money you pump in as deposits and top-up, factors in mortgage rate changes 2. Value your property based on market size, how many buyers/sellers are competing with you, translated into rental returns, including periodic rental increases 3. Calculate the full income/benefits of your property based on tenure, the longer the tenure, the more overall income, but how long a tenure (hint, not the 99 years) 4. Factor in your risk appetite, which changes with time, from marriage, with children, empty nest/retirement 5. Finally, don't forget the time value of money, a dollar today is worth less in 10 or even 5 years hence, determine this now, today before, you sign on the dotted line. The handbook also, helps you to empirically factor in and trade off subjective elements such as (for example), home near office vs. near shopping, transport and other amenities; proximity to schools vs. grandparents; good facing/feng shui vs. price; and other attributes that you prefer. A must-read book before committing to buy/sell/hold property worth hundreds of thousands and even millions of dollars

Mode of access: World Wide Web